Money Managers are able to set up fees for carrying out trades on behalf of their investors. It would be beneficial for both parties to understand the terminology relating to these fees prior to setting up or accepting an offer.

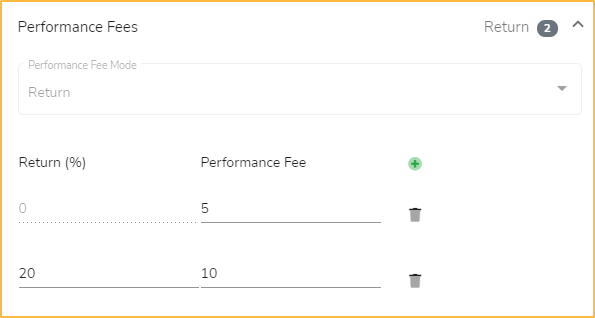

Performance Fee

- In the case that the Money Manager has a lot of trading expertise, they are able to charge a Performance fee. This service fee enables the Money Manager to obtain a share of the profit generated.

- These percentage cuts from the profit gained can be structured differently depending on the amount of profit gained.

- In the sample image below, the return percentage shows that if a Money Manager makes between 0 to 20% in profit return, the Investor will be charged 5% in performance fees. Profit return of 20% onwards will cost a 10% fee.

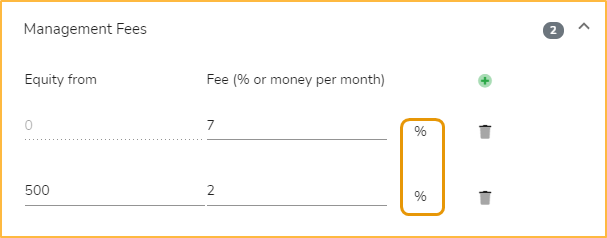

- A Money Manager can also choose to ask for charges for caring for an Investors funds and trading them.

- This type of fee is referred to as the Management Fee.

- The Manager may ask for a percentage cut based on the number of funds contributed by the investor or a set amount. This can be changed by clicking on the % or $ symbol near the value.

- If the charge is tiered, it will typically drop as the investment grows.

- As can be seen in the sample image below, the Investor will be getting charged 7% amount of funds for every $0 – $500 deposited. If the Investor deposits upwards of $500, they will be charged 2% instead.

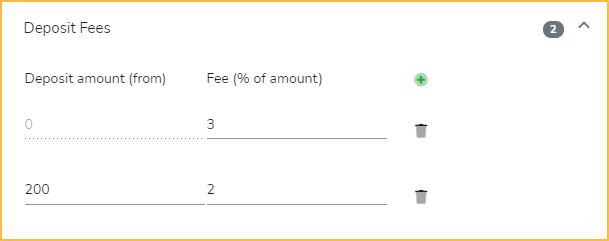

Deposit Fee

- This type of fee is charged each time an Investor adds funds into your Fund.

- From the sample image below, it can be seen that depositing from $0 to $200 would incur a 3% fee. On the other hand, deposits above $200 would charge a lesser fee of 3%.